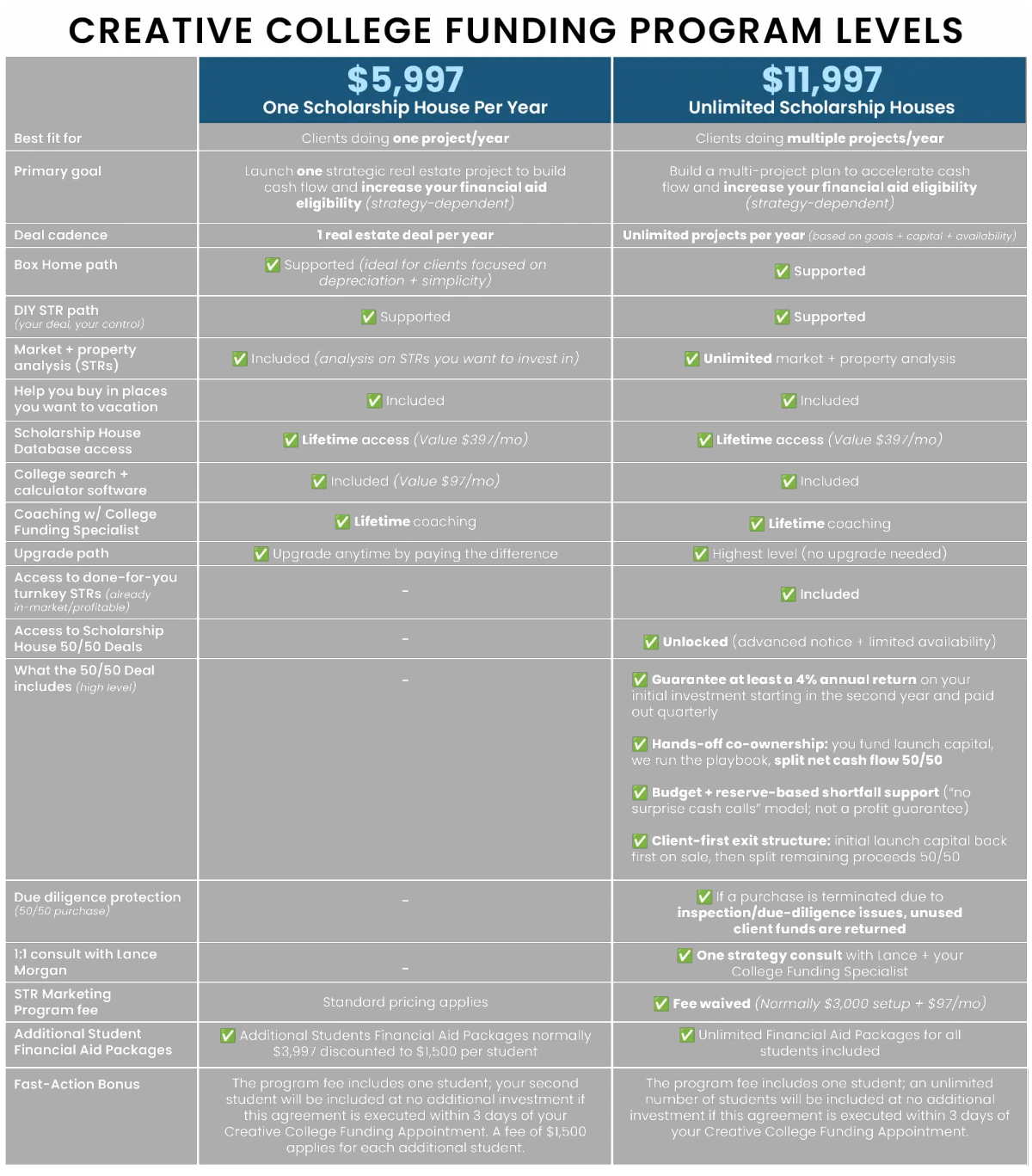

Helping High-Income Families Send ANY Student To ANY School Of Their Choice While Still Increasing Their Retirement Income Using Real Estate

-

-

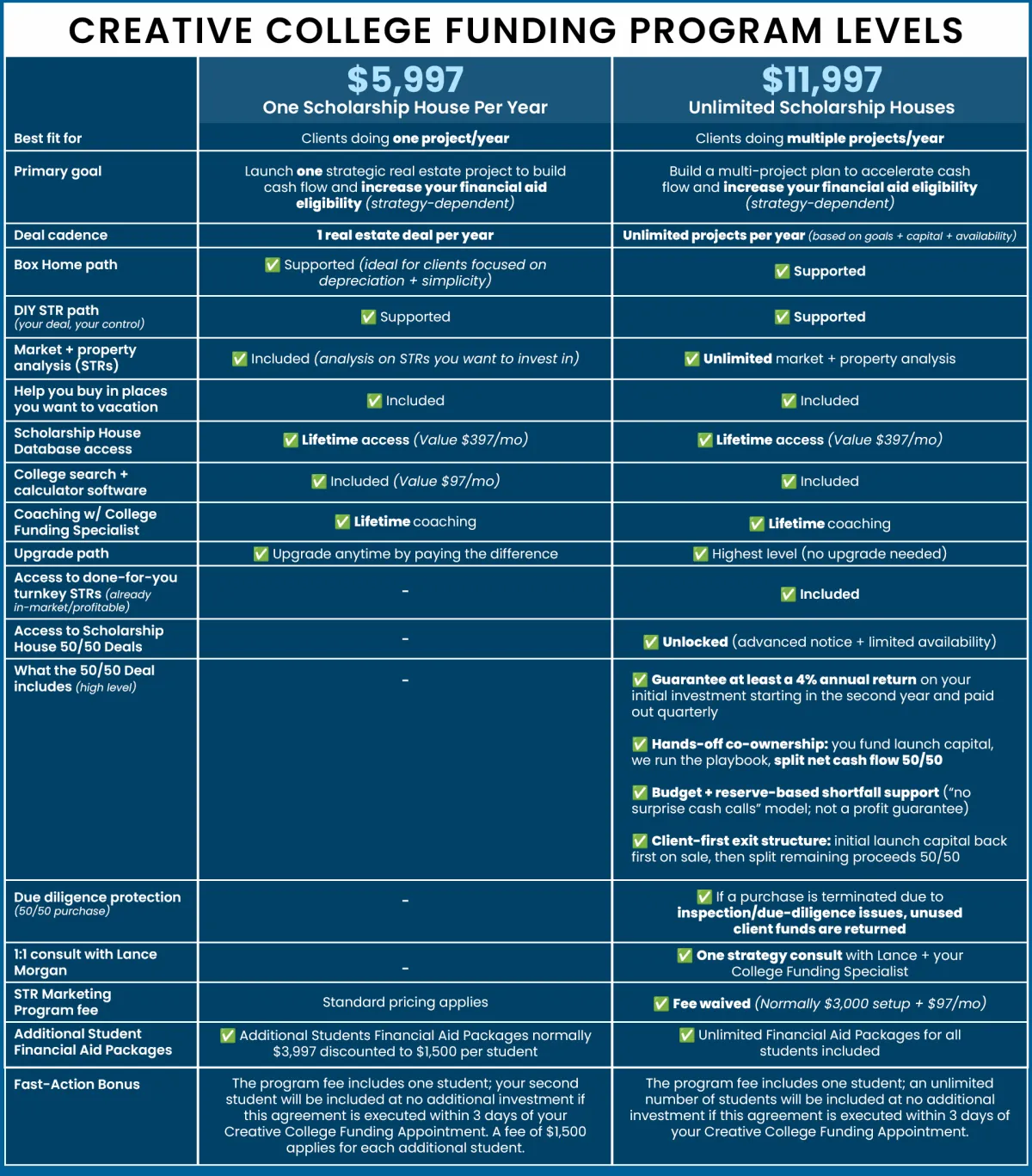

5 Step Program Details

Step 1: Onboarding & High-Level Game Planning

Meet Your College Funding Specialist Who Will Walk You Through Our 5-Step Process

Review The 5-Step Process

Schedule Appointments with Specialists

Intro and Overview of Our Private Members Only Portal

Start Looking in our Members Area for Creative Financing Properties

Create a Big Picture High-Level College Funding Game Plan

Start Building Your College Funding Plan Using Our Financial Roadmap Software

Establish the “Before” Current Scenario to Compare Later

Discuss Priorities and Next Steps

Step 2: Financial Positioning Strategies

Meet With Our Financial Aid Specialist

Dial In the Initial SAI and EFC Projections

Discuss Income Target for Max Financial Aid

Discuss Asset Repositioning Strategies for Max Financial Aid

Create a High-Level Strategy to Maximize Free Money for College

Narrow Down College Selection by Financial Fit in Our College Cost Secrets Software

Calculate Estimated Costs of College and College Loans

Complete The Financial Aid Forms (Fall of Senior Year)

Appeal Financial Aid Offers (Spring of Senior Year)

Step 3: Real Estate and Creative College Funding

Meet With Our Real Estate Team

Discuss Overall Real Estate Goals and Options

Decide The Best Real Estate Option to Achieve Your Goals

Turnkey Airbnb Properties

Traditional vs Creative Listings

Traditional vs Creative Financing

Invest In Others Airbnb Properties

Tiny Box Homes (For Max Tax Savings)

Discuss Which Assets will be “Repositioned” to Real Estate

Work With Your College Funding Specialist to Estimate College Loan Payments

Continue Looking for Properties That Meet Your College Funding Goals

Work with Our Team to Underwrite Properties for Maximum Net Cashflow

Work With Our Team to Run Cost Segregation Studies for Maximum Tax Savings

Work With Our Team to Perform Any and All Due Diligence Before Purchasing

Work With Our Team to Purchase the Real Estate

Work With Our Partners for Renovations, Furnishing, and Staging to Create a Top 1% Airbnb Experience

Marketing and Staging to Create a Top 1% Airbnb Experience

Setup Professional Management with our “Hands Off” Management Services

Work With Our Tech Team to Setup a Web Page for Each Property

Work With Our Tech Team to Setup a Guest Database for Repeat Business

Update Your Financial Roadmap with the Estimated Tax Savings and Real Estate Cash Flow

Work With our Real Estate Team to Wash, Rinse, and Repeat for Multiple Properties

Step 4: Private Reserve Strategy and Repositioning Assets

Create a Private Reserve Strategy for:

⦿ Earnest Money

⦿ Down Payments

⦿ Closing Costs

⦿ Mortgage Payments During Setup

⦿ Renovations and Staging

⦿ Unexpected Expenses

Leverage Layering Strategies

Additional Investment Opportunities

Compare Private Reserve Accounts

Discuss The 3rd and “Secret” Cost of College and How to Minimize It

Discuss Which Assets Need to Be Repositioned

Compare Pros and Cons to Moving Assets (Including Tax Implications)

Find Additional Money for the Private Reserve Strategy and Additional or Future Real Estate Investing by Avoiding the Top 5 Financial Mistakes

Retirement Savings

Mortgage Paydown and Home Equity

Additional Tax Savings

Insurance Savings

Debt Elimination Strategies

Learn The Retirement Scholarship Strategy for Long-Term Tax Savings

Update Your Financial Roadmap with Your Private Reserve Strategy and Retirement Scholarship Strategy

Step 5: Retirement Restoration From College Funding

See How to Pay for Any Student to Go to Any School of their Choice and Still Increase Your Retirement Income

Learn Additional Ways to Increase Retirement Income and “Makeup” for the cost of College Funding

Update Retirement Income Projections from Real Estate Income, Appreciation, and Retirement Scholarship Strategies

Compare Before and After Retirement Income and Tax Savings Using Our Financial Roadmap Software

Discuss Long-Term Real Estate Strategies

Discuss Long-Term Tax Strategies

Discuss Legacy Planning

We guarantee that the strategies provided in the program will result in at least $50,000 in total savings. On top of that, we're committed to helping you take real, measurable steps toward creating a college-funding asset. If, after 12 months inside the Creative College Funding Program, you have not secured either a short-term rental (“STR”) property or a Box Home, simply email us within 14 days of your 12-month anniversary, and we will refund 100% of your program tuition.

HEAR FROM OUR CLIENTS →

Success Stories

“I'm Kevin Harrington original shark from shark tank and I recommend these strategies. I wish I knew you when I was going to school.”

"For a small investment, I’ve experienced a 1,000% return and discovered the most brilliant strategy to pay for college while building real, generational wealth."

“My son was looking at two colleges—one public, one private—and the private one was actually half the cost because they gave so much more free money than the public school.”

“The College Funding Secrets plan has given my wife and I peace of mind and security in knowing that we’re going to be able to send both of our kids to college and also be able to retire.”

“I never thought I could keep my college savings and allow it to keep earning interest."

“Having a real plan for college costs gave us peace of mind and freedom we never thought possible.”

“I regret waiting so long to check this out—it's been a total game changer for our family.”

“I was amazed at how simple and beneficial it is—I’m so glad I found this approach.”

“Why did I not know this existed before now?”

“Working with College Funding Secrets just really did give me peace of mind and it was also really nice to know that whatever dollars we were setting aside for college we’re also compounding overtime. So we were actually MAKING money.”

“College Funding Secrets is really just trying to make sure that parents understand that anyone can send their child to college… and the college that they want.”

MEET OUR TEAM →

College Funding Specialists

MEET OUR FOUNDER →

Lance Morgan

“Parents shouldn’t have to choose between funding their child’s dream and protecting their own retirement. I created College Funding Secrets to eliminate that trade-off.”

Best-selling author & Certified Financial Educator™

20+ years guiding affluent families through college-funding minefields

Over $100 million secured in scholarships, tax savings, and retirement-restoration strategies

Presenter for TIGER 21, CFA Society, Barron’s Top Advisors Summit

Copyright © 2026. Creative College Funding. All Rights Reserved.